Including funds on to your account. Understand that contributions are topic to once-a-year IRA contribution limitations set through the IRS.

Not like shares and bonds, alternative assets are often more difficult to provide or can have demanding contracts and schedules.

After you’ve identified an SDIRA provider and opened your account, you may well be thinking how to truly commence investing. Knowing both The foundations that govern SDIRAs, and also how you can fund your account, might help to put the inspiration to get a way forward for productive investing.

The tax rewards are what make SDIRAs interesting For most. An SDIRA can be each standard or Roth - the account form you decide on will rely mostly with your investment and tax approach. Check out with the money advisor or tax advisor when you’re unsure which can be best for you.

Selection of Investment Options: Make sure the provider will allow the categories of alternative investments you’re interested in, for instance property, precious metals, or private equity.

Increased Expenses: SDIRAs generally have bigger administrative costs in comparison with other IRAs, as specific facets of the administrative procedure cannot be automatic.

Criminals often prey on SDIRA holders; encouraging them to open accounts for the goal of building fraudulent investments. They typically fool buyers by telling them that In case the investment is accepted by a self-directed IRA custodian, it must be legit, which isn’t correct. Again, You should definitely do comprehensive homework on all investments you select.

Complexity and Obligation: With an SDIRA, you've got far more Command over your investments, but In addition, you bear far more accountability.

Transferring resources from one sort of account to another form of account, which include moving resources from the 401(k) to a standard IRA.

The key SDIRA principles in the IRS that buyers require to grasp are investment limitations, disqualified persons, and prohibited transactions. Account holders will have to abide by SDIRA policies and laws so that you can protect the tax-advantaged position of their account.

Quite a few traders are stunned to know that applying retirement resources to take a position in alternative assets has become attainable considering that 1974. Even so, most brokerage firms and financial institutions i thought about this target supplying publicly traded securities, like shares and bonds, given that they lack Read Full Article the infrastructure and know-how to manage privately held assets, which include real-estate or private equity.

Have the freedom to speculate in Just about any sort of asset that has a chance profile that matches your investment method; which include assets that have the prospective for a greater rate of return.

Occasionally, the expenses linked to SDIRAs can be increased and even more complicated than with an everyday IRA. It's because of the enhanced complexity associated with administering the account.

Subsequently, they have an inclination not to advertise self-directed IRAs, which provide the flexibility to speculate in a very broader choice of assets.

Feel your Buddy might be starting off the following Fb or Uber? Using an SDIRA, you are able to put money into brings about that you believe in; and possibly take pleasure in increased returns.

Entrust can help you in buying alternative investments together with your retirement resources, and administer the obtaining and this content marketing of assets that are typically unavailable through banking companies and brokerage firms.

Place only, when you’re looking for a tax effective way to construct a portfolio that’s a lot more tailor-made in your interests and experience, an SDIRA could possibly be the answer.

This contains knowing IRS regulations, running investments, and preventing prohibited transactions that would disqualify your IRA. A lack of data could cause costly issues.

Buyer Assistance: Try to look for a supplier which offers devoted aid, which includes usage of experienced specialists who will solution questions about compliance and IRS procedures.

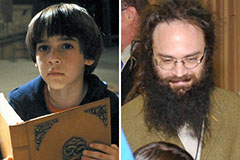

Barret Oliver Then & Now!

Barret Oliver Then & Now! Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now!